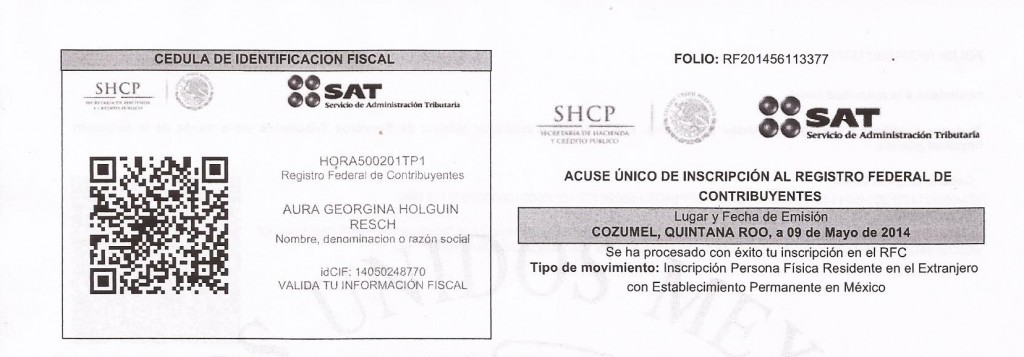

The RFC is your Tax Identification Number, needed if you are selling or providing services that create revenues. It is issued by SAT, Secretary of Hacienda and Public Credit, the Mexican version of the IRS or Revenue Canada. As of September 2014, it is needed in order to sell or purchase Mexican Property. It is my understanding that you can start the process by applying on line at www.sat.gob.mx using your CURP number. I applied at the SAT office on 30th. I took along all my copies of: CURP, Immigration Credential, Utility Bill, and Copy of my Passport front Page. In no time I was issued a tax ID number, (RFC) and handed a how to disk with instructions and informational pamphlets. You can make an appointment with their accountant who can assist you on a one to one basis if you run across any problems. I am able to issue and receive Facturas for my work with The Cozumel Sun. I am able to do it all on-line including filing my taxes every two months. An RFC number will enable you to receive facturas for your home improvements and repairs to offset your capital gains tax in time of sales. The document is letter size. The above illustration is what the very top of the document looks like.

The RFC is your Tax Identification Number, needed if you are selling or providing services that create revenues. It is issued by SAT, Secretary of Hacienda and Public Credit, the Mexican version of the IRS or Revenue Canada. As of September 2014, it is needed in order to sell or purchase Mexican Property. It is my understanding that you can start the process by applying on line at www.sat.gob.mx using your CURP number. I applied at the SAT office on 30th. I took along all my copies of: CURP, Immigration Credential, Utility Bill, and Copy of my Passport front Page. In no time I was issued a tax ID number, (RFC) and handed a how to disk with instructions and informational pamphlets. You can make an appointment with their accountant who can assist you on a one to one basis if you run across any problems. I am able to issue and receive Facturas for my work with The Cozumel Sun. I am able to do it all on-line including filing my taxes every two months. An RFC number will enable you to receive facturas for your home improvements and repairs to offset your capital gains tax in time of sales. The document is letter size. The above illustration is what the very top of the document looks like.

The Cozumel Sun News

RFC: HORA500201TP1

Papeleria y Novedades Mama lilly

RFC: RFC: MAMB780915969

987-118-4453 CELL

386-445-8702 USA

auraholguin@thecozumelsun.com

mapapeleria@outlook.com